Khác biệt giữa bản sửa đổi của “Hãng hàng không”

Không có tóm lược sửa đổi |

Không có tóm lược sửa đổi Thẻ: Thêm tập tin Thêm liên kết dưới Liên kết ngoài hoặc Tham khảo Qua trình soạn thảo trực quan: Đã chuyển Liên kết định hướng |

||

| Dòng 1: | Dòng 1: | ||

{{ |

{{đang dịch 2}} |

||

[[File:Europe to South American in 3 Days Poster (19482266291).jpg|thumb|Bức áp phích [[quảng cáo]] dịch vụ bưu phẩm hàng không hàng tuần từ Deutsche Lufthansa, Syndicato Condor và Deutsche Zeppelin Reederei của [[Đức]] vào [[thập niên 1930]].]] |

|||

'''Hãng hàng không ''' là doanh nghiệp kinh doanh vận chuyển hàng không, bao gồm: vận chuyển hàng không (khách hàng, hành lý,...), quảng cáo, tiếp thị, bán sản phẩm hàng không (vé) trên thị trường nhằm mục đích sinh lợi. Tại Việt Nam hiện có các hãng hàng không: [[Hãng hàng không Quốc gia Việt Nam|Vietnam Airlines]], [[Jetstar Pacific Airlines]], [[Công ty Cổ phần Hàng không VietJet]], [[Bamboo Airways]]. |

|||

'''Hãng hàng không''' là một công ty vận chuyển [[hành khách]] và [[hàng hóa]] bằng [[máy bay]]. Các hãng hàng không có thể hợp tác với nhau để cung cấp các chuyến bay liên danh, nghĩa là họ cùng cung cấp và khai thác cùng một chuyến bay. Hãng hàng không đầu tiên trên thế giới là DELAG của [[Đức]], được thành lập vào ngày [[16 tháng 11]] năm [[1909]].<ref name=":0" /> Bốn hãng hàng không lâu đời nhất vẫn tồn tại cho đến ngày nay là [[KLM]] (1919) của [[Hà Lan]],<ref>{{Cite web |date=2021-04-02 |title=Top 10: The Oldest Airlines In The World |url=https://simpleflying.com/10-oldest-airlines/ |access-date=2023-07-17 |website=Simple Flying |language=en}}</ref> [[Avianca]] (1919) của [[Colombia]],<ref name=":2">{{Cite web|url=http://www.aviancaholdings.com/en/history|title=History - Avianca Holdings S.A. - www.aviancaholdings.com|website=www.aviancaholdings.com|access-date=14 October 2017|archive-date=October 15, 2017|archive-url=https://web.archive.org/web/20171015094943/http://www.aviancaholdings.com/en/history|url-status=dead}}</ref> [[Qantas]] (1920) của [[Úc]]<ref name=":3">{{Cite web|url=https://www.qantas.com/travel/airlines/history-founders/global/en|title=Founders of Qantas {{!}} Qantas|website=www.qantas.com|language=en-AU|access-date=14 October 2017}}</ref> và [[Mexicana de Aviación]] (1921) của [[Mexico]].<ref name=":4">{{Cite web|url=https://www.csa.cz/cz-en/about-us/|title=About Us {{!}} Czech Airlines|website=ČSA.cz|language=en|access-date=14 October 2017}}</ref> |

|||

Theo chiến lược kinh doanh và cách định giá, người ta thường chia các hãng hàng không ra làm hai loại: hãng hàng không truyền thống (như Vietnam Airlines) và hãng hàng không giá rẻ (Jetstar Pacific Airlines, VietJet Air). Theo mức ưu đãi thị phần, người ta chia thành [[hãng hàng không quốc gia]] và hãng hàng không tư nhân. |

|||

Quyền sở hữu hãng hàng không đã trải qua sự thay đổi từ chủ yếu là sở hữu cá nhân cho đến [[thập niên 1930]] sang sở hữu nhà nước đối với các hãng hàng không lớn từ [[thập niên 1940]] đến [[thập niên 1980]] và trở lại tư nhân hóa quy mô lớn sau giữa thập niên 1980.<ref name=":5">{{Cite book|url=https://books.google.com/books?id=xK4QxAVSd5gC&pg=PA185|title=The Airline Business in the Twenty-first Century|last=Doganis|first=Rigas|date=2001|publisher=Psychology Press|isbn=978-0-415-20883-3|pages=185|language=en}}</ref> Kể từ những năm 1980, đã có xu hướng sáp nhập các hãng hàng không lớn và thành lập các liên minh hàng không. Các liên minh lớn nhất là [[Star Alliance]], [[SkyTeam]] và [[Oneworld]]. Các liên minh hàng không phối hợp các chương trình dịch vụ hành khách của họ (chẳng hạn như phòng chờ và chương trình khách hàng thân thiết), cung cấp vé liên tuyến đặc biệt và thường tham gia vào việc chia sẻ mã hàng không rộng rãi (đôi khi là toàn hệ thống). |

|||

== Tham khảo == |

|||

{{tham khảo}} |

|||

{{thể loại Commons|Airlines}} |

|||

== Lịch sử == |

|||

{{sơ khai hàng không}} |

|||

{{Hàng không thương mại}} |

|||

=== Những hãng hàng không đầu tiên === |

|||

{{Kiểm soát tính nhất quán}}[https://cebupacific.vn/ Đại lý Cebu Pacific] |

|||

DELAG, Deutsche Luftschiffahrts-Aktiengesellschaft I là hãng hàng không đầu tiên trên thế giới.<ref name=":0">{{cite web|url=https://www.airships.net/delag-passenger-zeppelins |title=DELAG: The World's First Airline, using dirgibles. |publisher=Airships.net |access-date=22 August 2010}}</ref> Nó được thành lập vào ngày 16 tháng 11 năm 1909, với sự hỗ trợ của chính phủ và vận hành các khinh khí cầu được sản xuất bởi The [[Zeppelin|Zeppelin Corporation]]. Trụ sở chính của nó đặt tại [[Frankfurt]]. |

|||

Hãng hàng không cố định đầu tiên với lịch trình bay thường xuyên được khởi động vào ngày 1 tháng 1 năm 1914. Chuyến bay được điều khiển bởi Tony Jannus <ref>{{Cite web |last=Airways |date=2023-08-13 |title=The History of Commercial Flight: How Global Travel Took off |url=https://airwaysmag.com/how-global-travel-took-off/ |access-date=2023-08-24 |website=Airways |language=en-US}}</ref> và bay từ [[St. Petersburg, Florida]], đến [[Tampa, Florida]], do [[St. Petersburg–Tampa Airboat Line]] vận hành.<ref>{{Cite news|url=https://www.space.com/16657-worlds-first-commercial-airline-the-greatest-moments-in-flight.html|title=World's First Commercial Airline {{!}} The Greatest Moments in Flight|work=Space.com|access-date=14 October 2017}}</ref> |

|||

===Europe=== |

|||

====Beginnings==== |

|||

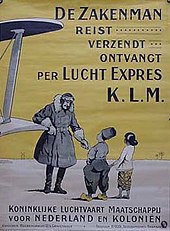

[[File:Klm-poster-1919.jpg|thumb|upright|A 1919 advertisement for the Dutch airline [[KLM]], founded on October 7, 1919, the [[List of airlines by foundation date|oldest running airline still operating under its original name]]]] |

|||

[[File:Tanken van een vliegtuig Airplane provided with fuel.jpg|thumb|The [[Handley Page Type W|Handley Page W.8b]] was used by [[Handley Page Transport]], an early British airline established in 1919.]] |

|||

The earliest fixed wing airline in Europe was [[Aircraft Transport and Travel]], formed by [[George Holt Thomas]] in 1916; via a series of takeovers and mergers, this company is an ancestor of modern-day [[British Airways]]. Using a fleet of former military [[Airco DH.4]]A biplanes that had been modified to carry two passengers in the [[fuselage]], it operated relief flights between [[Folkestone]] and [[Ghent]], Belgium. On July 15 , 1919, the company flew a proving flight across the [[English Channel]], despite a lack of support from the British government. Flown by Lt. H Shaw in an [[Airco DH.9]] between [[RAF Hendon]] and [[Paris – Le Bourget Airport]], the flight took 2 hours and 30 minutes at £21 per passenger. |

|||

On August 25, 1919, the company used [[Airco DH.16|DH.16s]] to pioneer a regular service from [[Hounslow Heath Aerodrome]] to Paris's [[Paris–Le Bourget Airport|Le Bourget]], the first regular international service in the world. The airline soon gained a reputation for reliability, despite problems with bad weather, and began to attract European competition. In November 1919, it won the first British civil [[airmail]] contract. Six [[Royal Air Force]] [[Airco DH.9A]] aircraft were lent to the company, to operate the airmail service between [[Hawkinge]] and [[Cologne]]. In 1920, they were returned to the Royal Air Force.<ref>''The Putnam Aeronautical Review'' edited by John Motum, p170 Volume one 1990 Naval Institute Press</ref> |

|||

Other British competitors were quick to follow – [[Handley Page Transport]] was established in 1919 and used the company's converted [[World War I|wartime]] [[Handley Page Type O|Type O/400]] [[bomber]]s with a capacity for 12 passengers,<ref>{{Cite web |url=https://www.flightglobal.com/FlightPDFArchive/1961/1961%20-%200055.PDF |title=The First Handley Page Transports |access-date=14 October 2017 |archive-url=https://web.archive.org/web/20160413004211/https://www.flightglobal.com/FlightPDFArchive/1961/1961%20-%200055.PDF |archive-date=13 April 2016 |url-status=dead }}</ref> to run a [[London]]-[[Paris]] passenger service.<ref>{{Cite web|url=http://www.airlinehistory.co.uk/Airline%20History/History1903.asp|title=Airline History 1903 to 1919|website=www.airlinehistory.co.uk|access-date=14 October 2017}}</ref> |

|||

The first French airline was [[Aéropostale (aviation)|Société des lignes Latécoère]], later known as Aéropostale, which started its first service in late 1918 to Spain. The [[Société Générale des Transports Aériens]] was created in late 1919, by the [[Farman]] brothers and the [[Farman F.60 Goliath]] plane flew scheduled services from [[Toussus-le-Noble]] to [[Kenley]], near [[Croydon]], England. Another early French airline was the [[Compagnie des Messageries Aériennes]], established in 1919 by [[Louis-Charles Breguet]], offering a mail and freight service between [[Paris – Le Bourget Airport|Le Bourget Airport]], [[Paris]] and [[Lesquin Airport]], [[Lille]].<ref>{{cite web|url=http://www.rafmuseum.org.uk/milestones-of-flight/world/1919.cfm |title=World Aviation in 1919 - Part 1 |publisher=Royal Air Force Museum |access-date=28 February 2011 |url-status=dead |archive-url=https://web.archive.org/web/20110105130943/http://www.rafmuseum.org.uk/milestones-of-flight/world/1919.cfm |archive-date=5 January 2011 }}</ref> |

|||

[[File:Bundesarchiv Bild 102-00007, Berlin, Start eines Junkers-Flugzeuges.jpg|thumb| [[Junkers F.13]] ''D-190'' of [[Junkers Luftverkehr]]]] |

|||

The first German airline to use heavier than air aircraft was [[Deutsche Luft-Reederei]] established in 1917 which started operating in February 1919. In its first year, the D.L.R. operated regularly scheduled flights on routes with a combined length of nearly 1000 miles. By 1921 the D.L.R. network was more than 3000 km (1865 miles) long, and included destinations in the Netherlands, Scandinavia and the Baltic Republics. Another important German airline was [[Junkers Luftverkehr]], which began operations in 1921. It was a division of the aircraft manufacturer [[Junkers]], which became a separate company in 1924. It operated joint-venture airlines in Austria, Denmark, Estonia, Finland, Hungary, Latvia, Norway, Poland, Sweden and Switzerland.<ref>{{Cite web|url=https://www.hisour.com/history-of-airline-37830/|title=History of Airline |website=www.hisour.com|date=16 August 2018 |access-date=17 February 2021}}</ref> |

|||

The [[Netherlands|Dutch]] airline [[KLM]] made its first flight in 1920, and is the oldest continuously operating airline in the world. Established by aviator [[Albert Plesman]],<ref>{{cite journal|journal=International Directory of Company Histories|year=1999|volume=28|title=Koninklijke Luchtvaart Maatschappij, N.V. History| url=http://www.fundinguniverse.com/company-histories/koninklijke-luchtvaart-maatschappij-n-v-history/|access-date=30 July 2013}}</ref> it was immediately awarded a "Royal" predicate from [[Wilhelmina of the Netherlands|Queen Wilhelmina]].<ref>{{cite web|title=History|url=http://www.klm.com/corporate/en/about-klm/history/index.html|work=KLM Corporate|publisher=KLM|access-date=30 July 2013}}</ref> Its first flight was from [[Croydon Airport]], [[London]] to [[Amsterdam]], using a leased [[Aircraft Transport and Travel]] [[Airco DH.16|DH-16]], and carrying two British journalists and a number of newspapers. In 1921, KLM started scheduled services.<ref>{{cite news|url=https://metroairportnews.com/celebrating-klm-royal-dutch-airlines-100th-anniversary/|title=Celebrating KLM Royal Dutch Airlines 100th Anniversary|first=Joseph|last=Alba|date=7 October 2019|publisher=Metropolitan Airport News|quote=In 1921, KLM started scheduled services.|access-date=22 October 2021}}</ref> |

|||

In [[Finland]], the charter establishing Aero O/Y (now [[Finnair]]) was signed in the city of [[Helsinki]] on 12 September 1923. [[Junkers F.13]] D-335 became the first aircraft of the company, when Aero took delivery of it on 14 March 1924. The first flight was between Helsinki and [[Tallinn]], capital of [[Estonia]], and it took place on 20 March 1924, one week later.<ref>{{cite web |title=Finnair's first flight took place 90 years ago {{!}} Finavia |url=https://www.finavia.fi/en/newsroom/2014/finnairs-first-flight-took-place-90-years-ago |website=www.finavia.fi |access-date=7 May 2020 |language=en |date=19 March 2014}}</ref> |

|||

In the [[Soviet Union]], the Chief Administration of the Civil Air Fleet was established in 1921. One of its first acts was to help found Deutsch-Russische Luftverkehrs A.G. (Deruluft), a German-Russian joint venture to provide air transport from Russia to the West. Domestic air service began around the same time, when Dobrolyot started operations on 15 July 1923 between Moscow and Nizhni Novgorod. Since 1932 all operations had been carried under the name [[Aeroflot]].<ref>{{Cite web|url=https://www.aeroflot.ru/us-en/about/history|title=Aeroflot History {{!}} Aeroflot|website=www.aeroflot.ru|language=en|access-date=14 October 2017}}</ref> |

|||

Early European airlines tended to favor comfort – the passenger cabins were often spacious with luxurious interiors – over speed and efficiency. The relatively basic navigational capabilities of pilots at the time also meant that delays due to the weather were commonplace.<ref>{{Cite web|title=History of flight - The first airlines|url=https://www.britannica.com/technology/history-of-flight|access-date=14 September 2020|website=Encyclopedia Britannica|language=en}}</ref> |

|||

====Rationalization==== |

|||

[[File:National Audit Office - Victoria - London - 020504.jpg|upright=0.7|thumb|The [[Imperial Airways]] Empire Terminal, [[Victoria, London]]. Trains ran from here to [[flying boats]] in [[Southampton]], and to [[Croydon Airport]].]] |

|||

By the early 1920s, small airlines were struggling to compete, and there was a movement towards increased rationalization and consolidation. In 1924, [[Imperial Airways]] was formed from the merger of [[Instone Air Line|Instone Air Line Company]], [[British Marine Air Navigation Co Ltd|British Marine Air Navigation]], [[Daimler Airway]] and [[Handley Page Transport]], to allow British airlines to compete with stiff competition from French and German airlines that were enjoying heavy government subsidies. The airline was a pioneer in surveying and opening up air routes across the world to serve far-flung parts of the [[British Empire]] and to enhance trade and integration.<ref>{{cite web|url = http://www.flightglobal.com/pdfarchive/view/1923/1923%20-%200760.html |title = Imperial Air Transport Company: Appointment of Government Directors|work = Flight|date = 20 December 1923|page = 760}}</ref> |

|||

The first new airliner ordered by Imperial Airways, was the [[Handley Page W8f]] ''City of Washington'', delivered on 3 November 1924.<ref>{{Cite web |url=http://www.century-of-flight.net/Aviation%20history/coming%20of%20age/imperial%20airways.htm |title=Imperial Airways |access-date=1 October 2013 |archive-url=https://web.archive.org/web/20150923201958/http://www.century-of-flight.net/Aviation%20history/coming%20of%20age/imperial%20airways.htm |archive-date=23 September 2015 |url-status=dead }}</ref> In the first year of operation the company carried 11,395 passengers and 212,380 letters. In April 1925, the film ''[[The Lost World (1925 film)|The Lost World]]'' became the first film to be screened for passengers on a scheduled airliner flight when it was shown on the London-Paris route. |

|||

Two French airlines also merged to form [[Air Union]] on 1 January 1923. This later merged with four other French airlines to become [[Air France]], the country's flagship carrier to this day, on 17 May 1933.<ref>{{Cite book|title=Britannica Concise Encyclopedia|publisher=Britannica Digital Learning|year=2017|pages=Air France|via=Credo Reference}}</ref> |

|||

Germany's [[Deutsche Lufthansa]] was created in 1926 by merger of two airlines, one of them [[Junkers Luftverkehr]]. Lufthansa, due to the [[Hugo Junkers|Junkers]] heritage and unlike most other airlines at the time, became a major investor in airlines outside of Europe, providing capital to [[Varig]] and Avianca. German airliners built by [[Junkers (Aircraft)|Junkers]], [[Dornier GmbH|Dornier]], and [[Fokker]] were among the most advanced in the world at the time.{{Citation needed|date=January 2020}} |

|||

====Expansion==== |

|||

In 1926, [[Alan Cobham]] surveyed a flight route from the UK to [[Cape Town]], [[South Africa]], following this up with another proving flight to [[Melbourne]], [[Australia]]. Other routes to [[British India]] and the [[Far East]] were also charted and demonstrated at this time. Regular services to [[Cairo]] and [[Basra]] began in 1927 and were extended to [[Karachi]] in 1929. The London-[[Australia]] service was inaugurated in 1932 with the [[Handley Page HP 42]] airliners. Further services were opened up to [[Kolkata|Calcutta]], [[Rangoon]], [[Singapore]], [[Brisbane]] and [[Hong Kong]] passengers departed London on 14 March 1936 following the establishment of a branch from Penang to Hong Kong.{{Citation needed|date=January 2020}} |

|||

[[File:Imperial routes April 1935.jpg|thumb|April 1935 map showing [[Imperial Airways]]' routes from the [[United Kingdom|UK]] to [[Australia]] and [[Union of South Africa|South Africa]]]] Imperial's aircraft were small, most seating fewer than twenty passengers, and catered for the rich. Only about 50,000 passengers used Imperial Airways in the 1930s. Most passengers on intercontinental routes or on services within and between British colonies were men doing colonial administration, business or research.<ref>Pirie, G.H. Incidental tourism: British imperial air travel in the 1930s. ''Journal of Tourism History'', 1 (2009) 49–66.</ref> |

|||

Like Imperial Airways, [[Air France]] and [[KLM]]'s early growth depended heavily on the needs to service links with far-flung colonial possessions ([[French North Africa|North Africa]] and [[French Indochina|Indochina]] for the French and the [[Dutch Indies|East Indies]] for the Dutch). France began an air mail service to [[Morocco]] in 1919 that was bought out in 1927, renamed [[Aéropostale (aviation)|Aéropostale]], and injected with capital to become a major international carrier. In 1933, Aéropostale went [[Bankruptcy|bankrupt]], was nationalized and merged into [[Air France]].<ref>{{cite web |title=History of AEROPOSTALE. |url=http://postale.free.fr/aeropostale.htm |website=Aeropostale |access-date=9 June 2018}}</ref> |

|||

Although Germany lacked colonies, it also began expanding its services globally. In 1931, the airship [[LZ 127 Graf Zeppelin|Graf Zeppelin]] began offering regular scheduled passenger service between Germany and South America, usually every two weeks, which continued until 1937.<ref>{{cite web|url=http://www.airships.net/lz127-graf-zeppelin/history |title=LZ-127 Graf Zeppelin |publisher=Airships.net |access-date=22 August 2010}}</ref> In 1936, the airship [[LZ 129 Hindenburg|Hindenburg]] entered passenger service and successfully crossed the Atlantic 36 times before crashing at Lakehurst, New Jersey, on 6 May 1937.<ref>{{cite web|url=http://www.airships.net/hindenburg |title=Hindenburg |publisher=Airships.net |date=10 June 2009 |access-date=22 August 2010| archive-url= https://web.archive.org/web/20101005073820/http://www.airships.net/hindenburg| archive-date= 5 October 2010 | url-status= live}}</ref> In 1938, a weekly air service from Berlin to [[Kabul]], [[Afghanistan]], started operating.<ref>{{Cite web |url=http://books.stonebooks.com/history/afghanistan.shtml |title=Stone & Stone: History Page |access-date=18 July 2020 |archive-url=https://web.archive.org/web/20190306105124/http://books.stonebooks.com/history/afghanistan.shtml |archive-date=6 March 2019 |url-status=dead }}</ref> |

|||

From February 1934 until World War II began in 1939, [[Deutsche Luft Hansa|Deutsche Lufthansa]] operated an airmail service from [[Stuttgart]], [[Germany]] via [[Spain]], the [[Canary Islands]] and West Africa to [[Natal, Rio Grande do Norte|Natal]] in [[Brazil]]. This was the first time an airline flew across an ocean.<ref>{{citation |url=https://books.google.com/books?id=pigDAAAAMBAJ&q=Popular+Science+1931+plane&pg=PA13 |title=First Transatlantic Air Line Links Two Continents|date=February 1933 |journal=Popular Science|pages = 13–15 and 104|volume = 122|issue = 2|editor-last = Brown|editor-first = Raymond J.}}</ref><ref name="Graue&Duggan">James W. Graue & John Duggan "Deutsche Lufthansa South Atlantic Airmail Service 1934–1939", Zeppelin Study Group, Ickenham, UK 2000 {{ISBN|0-9514114-5-4}}</ref> |

|||

By the end of the 1930s [[Aeroflot]] had become the world's largest airline, employing more than 4,000 pilots and 60,000 other service personnel and operating around 3,000 aircraft (of which 75% were considered obsolete by its own standards). During the Soviet era Aeroflot was synonymous with Russian civil aviation, as it was the only air carrier. It became the first airline in the world to operate sustained regular jet services on 15 September 1956 with the [[Tupolev Tu-104]].<ref>{{cite web |title=First sustained jet airline service |url=https://www.guinnessworldrecords.com/world-records/first-sustained-jet-airline-service/ |access-date=10 March 2020}}</ref> |

|||

====Deregulation==== |

|||

Deregulation of the [[European Union]] airspace in the early 1990s has had substantial effect on the structure of the industry there. The shift towards 'budget' airlines on shorter routes has been significant. Airlines such as [[EasyJet]] and [[Ryanair]] have often grown at the expense of the traditional national airlines. |

|||

There has also been a trend for these national airlines themselves to be privatized such as has occurred for [[Aer Lingus]] and [[British Airways]]. Other national airlines, including Italy's [[Alitalia]], suffered – particularly with the rapid increase of oil prices in early 2008.<ref>{{Cite web|url=http://www.dw.com/en/alitalia-future-hinges-on-rescue-package/a-1320328|title=Alitalia Future Hinges on Rescue Package|date=7 September 2004|website=DW.COM|language=en|access-date=14 October 2017}}</ref> |

|||

[[Finnair]], the largest airline of [[Finland]], had no fatal or hull-loss accidents since 1963, and is recognized for its safety.<ref>{{Cite news|url=https://finlandtoday.fi/finnair-is-the-safest-airline-in-the-world/|title=Finnair is the Safest Airline in the World|work=[[Finland Today]]|access-date=16 June 2020|language=en}}</ref><ref>{{Cite news|url=https://www.helsinkitimes.fi/finland/finland-news/domestic/16096-data-shows-finnair-was-world-s-safest-airline-in-2018.html|title=Data shows Finnair was world's safest airline in 2018|work=[[Helsinki Times]]|access-date=16 June 2020|language=en}}</ref><ref>{{Cite news|url=https://www.goodnewsfinland.com/finnair-one-of-the-world-s-safest-airlines/|title=Finnair one of the world's safest airlines|work=[[Good News from Finland]]|access-date=16 June 2020|language=en|archive-date=16 June 2020|archive-url=https://web.archive.org/web/20200616164414/https://www.goodnewsfinland.com/finnair-one-of-the-world-s-safest-airlines/|url-status=dead}}</ref> |

|||

===United States=== |

|||

{{main|Air transportation in the United States}} |

|||

====Early development==== |

|||

[[File:TWA 1940.jpg|thumb|[[TWA]] [[Douglas DC-3]] in 1940. The DC-3, often regarded as one of the most influential aircraft in the history of commercial aviation, revolutionized air travel.]] |

|||

[[Tony Jannus]] conducted the United States' first scheduled commercial airline flight on January 1, 1914 for the [[St. Petersburg-Tampa Airboat Line]].<ref name="Society">{{cite web|title=Tony Jannus, an enduring legacy of aviation|url=http://www.tonyjannusaward.com/history/|url-status=live|archive-url=https://web.archive.org/web/20110717073628/http://www.tonyjannusaward.com/history/|archive-date=17 July 2011|access-date=2 December 2010|work=Tony Jannus Distinguished Aviation Society|publisher=tonyjannusaward.com}}</ref> The 23-minute flight traveled between [[St. Petersburg, Florida]] and [[Tampa, Florida]], passing some {{convert|50|ft|m}} above Tampa Bay in Jannus' [[Benoist XIV]] wood and muslin biplane flying boat. His passenger was a former mayor of St. Petersburg, who paid $400 for the privilege of sitting on a wooden bench in the open cockpit. The Airboat line operated for about four months, carrying more than 1,200 passengers who paid $5 each.<ref>Carey, Susan, First airline offered no frills, many thrills, ''[[The Wall Street Journal]]'', December 31, 2013, p. B4</ref> [[Chalk's International Airlines]] began service between Miami and Bimini in the [[Bahamas]] in February 1919. Based in [[Ft. Lauderdale]], Chalk's claimed to be the oldest continuously operating airline in the United States until its closure in 2008.<ref>{{cite web |url=http://www.airportbusiness.com/web/online/Top-News-Headlines/CHALKS-AIRLINES-LOSES-FLIGHT-LICENSE-ITS-AIRPORT-LEASE-COULD-BE-CANCELED/1$15115 |title=Chalks Airlines Loses Flight License |publisher=airportbusiness.com |access-date=2 December 2010 |archive-url=https://web.archive.org/web/20110927221010/http://www.airportbusiness.com/web/online/Top-News-Headlines/CHALKS-AIRLINES-LOSES-FLIGHT-LICENSE-ITS-AIRPORT-LEASE-COULD-BE-CANCELED/1$15115 |archive-date=27 September 2011 |url-status=dead }}</ref> |

|||

Following [[World War I]], the United States found itself swamped with aviators. Many decided to take their war-surplus aircraft on barnstorming campaigns, performing aerobatic maneuvers to woo crowds. In 1918, the [[United States Postal Service]] won the financial backing of [[United States Congress|Congress]] to begin experimenting with [[air mail]] service, initially using [[Curtiss Jenny]]<ref>Amick, George. "How The Airmail Got Off The Ground." American History 33.3 (1998): 48. Academic Search Premier. Web. 3 November 2011.</ref> aircraft that had been procured by the [[United States Army Air Service]]. Private operators were the first to fly the mail but due to numerous accidents the US Army was tasked with mail delivery. During the Army's involvement they proved to be too unreliable and lost their air mail duties.<ref>{{Cite web|url=http://www.historynet.com/airmail-service-it-began-with-army-air-service-pilots.htm|title=Airmail Service: It Began with Army Air Service Pilots|website=www.historynet.com|date=12 June 2006|language=en-US|access-date=14 October 2017}}</ref> By the mid-1920s, the [[United States Postal Service|Postal Service]] had developed its own air mail network, based on a transcontinental backbone between [[New York City]] and [[San Francisco, California|San Francisco]].<ref>Clark, Anders (22 August 2014). "[https://disciplesofflight.com/big-arrow/ Now That's a Big Arrow]". Disciples of Flight. Retrieved 16 July 2015</ref> To supplement this service, they offered twelve contracts for spur routes to independent bidders. Some of the carriers that won these routes would, through time and mergers, evolve into [[Pan Am]], [[Delta Air Lines]], [[Braniff Airways]], [[American Airlines]], [[United Airlines]] (originally a division of [[Boeing]]), [[Trans World Airlines]], [[Northwest Airlines]], and [[Eastern Air Lines]]. |

|||

Service during the early 1920s was sporadic: most airlines at the time were focused on [[airmail#History|carrying bags of mail]]. In 1925, however, the [[Ford Motor Company]] bought out the [[William Bushnell Stout|Stout Aircraft Company]] and began construction of the all-metal [[Ford Trimotor]], which became the first successful American airliner. With a 12-passenger capacity, the Trimotor made passenger service potentially profitable.<ref>{{cite web | url = https://postalmuseum.si.edu/exhibits/current/airmail-in-america/the-airplanes/the-ford-trimotor.html | title = The Ford Trimotor and Douglas M-2 Mail Planes | work = Postal Museum | access-date = 27 July 2017 | archive-url = https://web.archive.org/web/20191006013802/https://postalmuseum.si.edu/exhibits/current/airmail-in-america/the-airplanes/the-ford-trimotor.html | archive-date = 6 October 2019 | url-status = dead }}</ref> Air service was seen as a supplement to [[rail transport|rail]] service in the American transportation network. |

|||

At the same time, [[Juan Trippe]] began a crusade to create an air network that would link America to the world, and he achieved this goal through his airline, [[Pan Am]], with a fleet of flying boats that linked [[Los Angeles]] to [[Shanghai]] and [[Boston]] to [[London]]. Pan Am and Northwest Airways (which began flights to Canada in the 1920s) were the only U.S. airlines to go international before the 1940s. |

|||

With the introduction of the [[Boeing 247]] and [[Douglas DC-3]] in the 1930s, the U.S. airline industry was generally profitable, even during the [[Great Depression]]. This trend continued until the beginning of [[World War II]].<ref>{{Cite book|url=https://books.google.com/books?id=ASLAUrX3UE8C&q=boeing+247+profitable&pg=PA62|title=A Companion to International History 1900–2001|last=Martel|first=Gordon|date=15 April 2008|publisher=John Wiley & Sons|isbn=9780470766293|language=en}}</ref> |

|||

====Since 1945==== |

|||

[[File:Stratocruiser op Schiphol, Bestanddeelnr 903-5913.jpg|thumb|[[Boeing 377]] of [[American Export Airlines]], the first airline to offer landplane flights across the North Atlantic in October 1945.<ref>{{cite web|url=http://www.centennialofflight.net/essay/Commercial_Aviation/atlantic_route/Tran4.htm |title=Air Transportation: The Beginnings of Commercial Transatlantic Service |publisher=centennialofflight.net |access-date=22 August 2010}}</ref>]] |

|||

World War II, like World War I, brought new life to the airline industry. Many airlines in the Allied countries were flush from lease contracts to the military, and foresaw a future explosive demand for civil air transport, for both passengers and cargo. They were eager to invest in the newly emerging flagships of air travel such as the [[Boeing Stratocruiser]], [[Lockheed Constellation]], and [[Douglas DC-6]]. Most of these new aircraft were based on American bombers such as the [[B-29]], which had spearheaded research into new technologies such as [[pressurization]]. Most offered increased efficiency from both added speed and greater payload.<ref>{{Cite web|title=history of airliners 1950 to 1959|url=http://www.century-of-flight.net/Aviation%20history/airliners/2nd%20upload/timeline%2050s1.htm|url-status=dead|archive-url=https://web.archive.org/web/20080517084004/http://www.century-of-flight.net/Aviation%20history/airliners/2nd%20upload/timeline%2050s1.htm|archive-date=17 May 2008|access-date=14 October 2017|website=www.century-of-flight.net}}</ref><ref>{{Cite web|url=https://www.jal.com/en/history/aircraft/60s/pick_61-70_01.html|title=History of JAL {{!}} DC-8-32|website=www.jal.com|access-date=14 October 2017}}</ref> |

|||

In the 1950s, the [[De Havilland Comet]], [[Boeing 707]], [[Douglas DC-8]], and [[Sud Aviation Caravelle]] became the first flagships of the Jet Age in the West, while the Eastern bloc had [[Tupolev Tu-104]] and [[Tupolev Tu-124]] in the fleets of state-owned carriers such as Czechoslovak [[Czech Airlines|ČSA]], Soviet [[Aeroflot]] and East-German [[Interflug]]. The [[Vickers Viscount]] and [[Lockheed L-188 Electra]] inaugurated turboprop transport. |

|||

On 4 October 1958, [[British Overseas Airways Corporation]] started [[transatlantic flight]]s between [[Heathrow Airport|London Heathrow]] and [[New York-Idlewild Airport|New York Idlewild]] with a Comet 4, and [[Pan Am]] followed on 26 October with a Boeing 707 service between New York and Paris.<ref>{{cite news |url= https://www.flightglobal.com/news/articles/analysis-how-the-jet-travel-era-began-in-earnest-449222/ |title= How the jet travel era began in earnest – 60 years ago |date= 4 October 2018 |author= Max Kingsley Jones |work= Flightglobal}}</ref> |

|||

The next big boost for the airlines would come in the 1970s, when the [[Boeing 747]], [[McDonnell Douglas DC-10]], and [[Lockheed L-1011]] inaugurated [[widebody]] ("jumbo jet") service, which is still the standard in international travel.<ref>{{Cite news|url=http://www.businessinsider.com/boeing-747-first-flight-47years-ago-2016-2|title=The Boeing 747 jumbo jet changed air travel with this momentous event 47 years ago|work=Business Insider|access-date=14 October 2017|language=en}}</ref> The [[Tupolev Tu-144]] and its Western counterpart, [[Concorde]], made supersonic travel a reality.<ref>{{Cite news|url=http://www.history.com/news/the-cold-war-race-to-build-the-concorde|title=The Cold War Race to Build the Concorde|work=HISTORY.com|access-date=14 October 2017}}</ref> Concorde first flew in 1969 and operated through 2003. In 1972, [[Airbus]] began producing Europe's most commercially successful line of airliners to date. The added efficiencies for these aircraft were often not in speed, but in passenger capacity, payload, and range. Airbus also features modern electronic cockpits that were common across their aircraft to enable pilots to fly multiple models with minimal cross-training.<ref>{{Cite web|url=https://airandspace.si.edu/exhibitions/america-by-air/online/jetage/jetage17.cfm|title = The Computer Revolution in the Cockpit | America by Air}}</ref> |

|||

====Deregulation==== |

|||

[[File:Pan Am Boeing 747 at Zurich Airport in May 1985.jpg|thumb|[[Pan Am]] [[Boeing 747]] ''Clipper Neptune's Car'' in 1985. The deregulation of the American airline industry increased the financial troubles of the airline which ultimately filed for bankruptcy in December 1991.<ref>{{cite web|url=http://www.centennialofflight.net/essay/Commercial_Aviation/Bankruptcy/Tran9.htm |title=Air Transportation: The Airline Bankruptcies of the 1980s |publisher=centennialofflight.net |access-date=22 August 2010}}</ref>]] |

|||

The 1978 U.S. [[Airline deregulation act|airline industry deregulation]] lowered federally controlled barriers for new airlines just as a downturn in the nation's economy occurred. New start-ups entered during the downturn, during which time they found aircraft and funding, contracted hangar and maintenance services, trained new employees, and recruited laid-off staff from other airlines. |

|||

Major airlines dominated their routes through aggressive pricing and additional capacity offerings, often swamping new start-ups. In the place of high barriers to entry imposed by regulation, the major airlines implemented an equally high barrier called [[loss leader]] pricing.<ref name="Andrew R. Thomas">{{cite news|url=http://my.safaribooksonline.com/book/current-affairs/9781430236771|title=Mr. Soft Landing: Airline Industry Strategy, Service, and Safety|publisher=Apress|year=2007|access-date=7 May 2012|archive-date=2 June 2012|archive-url=https://web.archive.org/web/20120602002044/http://my.safaribooksonline.com/book/current-affairs/9781430236771|url-status=dead}}</ref> In this strategy an already established and dominant airline stomps out its competition by lowering airfares on specific routes, below the cost of operating on it, choking out any chance a start-up airline may have. The industry side effect is an overall drop in revenue and service quality.<ref>{{cite web|url=http://asq.org/quality-report/10-year-analysis.html |website =American Society of Quality (ASQ)|title = The American Society for Quality Debuts Quarterly Quality Report with 10-Year Analysis}}</ref> Since deregulation in 1978 the average domestic ticket price has dropped by 40%.<ref>{{cite web|url=http://web.mit.edu/airlines/analysis/analysis_airline_industry.html |publisher =Massachusetts Institute of Technology|title = Airline Industry Overview}}</ref> So has airline employee pay. By incurring massive losses, the airlines of the USA now rely upon a scourge of cyclical Chapter 11 bankruptcy proceedings to continue doing business.<ref>{{cite web |url= http://www.slate.com/articles/business/moneybox/2011/12/blame_jimmy_carter_for_all_the_airline_bankruptcies_or_better_yet_thank_him_.html |title=Air Fail|publisher = Slate |work = Moneybox|date = 1 December 2011|last = Yglesias|first = Matthew}}</ref> [[America West Airlines]] (which has since merged with US Airways) remained a significant survivor from this new entrant era, as dozens, even hundreds, have gone under. |

|||

In many ways, the biggest winner in the deregulated environment was the air passenger. Although not exclusively attributable to deregulation, indeed the U.S. witnessed an explosive growth in demand for air travel. Many millions who had never or rarely flown before became regular fliers, even joining [[frequent flyer]] loyalty programs and receiving free flights and other benefits from their flying. New services and higher frequencies meant that business fliers could fly to another city, do business, and return the same day, from almost any point in the country. Air travel's advantages put long-distance intercity [[railroad]] travel and bus lines under pressure, with most of the latter having withered away, whilst the former is still protected under [[nationalization]] through the continuing existence of [[Amtrak]]. |

|||

By the 1980s, almost half of the total flying in the world took place in the U.S., and today the domestic industry operates over 10,000 daily departures nationwide. |

|||

Toward the end of the century, a new style of [[low-cost carrier|low cost airline]] emerged, offering a no-frills product at a lower price. [[Southwest Airlines]], [[JetBlue]], [[AirTran Airways]], [[Skybus Airlines]] and other low-cost carriers began to represent a serious challenge to the so-called "legacy airlines", as did their low-cost counterparts in many other countries.<ref>{{Cite news|url=http://www.cnn.com/travel/article/budget-airline-trends-2016/index.html|title=Budget airlines changed the world. What next?|date=21 March 2016|work=CNN Travel|access-date=14 October 2017|language=en}}</ref> Their commercial viability represented a serious competitive threat to the legacy carriers. However, of these, [[ATA Airlines|ATA]] and Skybus have since ceased operations. |

|||

Increasingly since 1978, US airlines have been reincorporated and [[off spin|spun off]] by newly created and internally led management companies, and thus becoming nothing more than operating units and subsidiaries with limited financially decisive control. Among some of these [[holding company|holding companies]] and [[parent company|parent companies]] which are relatively well known, are the [[UAL Corporation]], along with the [[AMR Corporation]], among a long [[list of airline holding companies]] sometime recognized worldwide. Less recognized are the [[private-equity firm]]s which often seize managerial, financial, and [[board of directors]] control of distressed airline companies by temporarily investing large sums of [[Equity (finance)|capital]] in air carriers, to rescheme an airlines assets into a profitable organization or [[liquidate|liquidating]] an air carrier of their profitable and worthwhile routes and business operations.{{Citation needed|date=January 2020}} |

|||

Thus the last 50 years of the airline industry have varied from reasonably profitable, to devastatingly depressed. As the first major market to deregulate the industry in 1978, U.S. airlines have experienced more turbulence than almost any other country or region. In fact, no U.S. [[legacy carrier]] survived bankruptcy-free. Among the outspoken critics of deregulation, former CEO of American Airlines, [[Robert Crandall]] has publicly stated: "Chapter 11 bankruptcy protection filing shows airline industry deregulation was a mistake."<ref>{{cite web|url=https://www.cnbc.com/id/45477274/AMR_Filing_Shows_Airline_Deregulation_Failed_Ex_CEO |title=Robert Cranall former CEO AA, CNBC |website=[[CNBC]] |url-status=dead |archive-url=https://web.archive.org/web/20130429202738/http://www.cnbc.com/id/45477274/AMR_Filing_Shows_Airline_Deregulation_Failed_Ex_CEO |archive-date=29 April 2013 }}</ref> |

|||

====Bailout==== |

|||

Congress passed the [https://www.congress.gov/bill/107th-congress/house-bill/2926 Air Transportation Safety and System Stabilization Act] (P.L. 107–42) in response to a severe liquidity crisis facing the already-troubled airline industry in the aftermath of the [[September 11 attacks]]. Through the [[Air Transportation Stabilization Board|ATSB]] Congress sought to provide cash infusions to carriers for both the cost of the four-day federal shutdown of the airlines and the incremental losses incurred through December 31, 2001, as a result of the terrorist attacks. This resulted in the first government bailout of the 21st century.<ref>{{cite web |url=http://ostpxweb.ost.dot.gov/aviation/Data/stabilizationact.pdf |title=Air Transportation Safety and System Stabilization Act |access-date=3 June 2009 |url-status=dead |archive-url=https://web.archive.org/web/20090409061950/http://ostpxweb.ost.dot.gov/aviation/Data/stabilizationact.pdf |archive-date=9 April 2009 }}</ref> Between 2000 and 2005 US airlines lost $30 billion with wage cuts of over $15 billion and 100,000 employees laid off.<ref name="Bamber, G.J., Gittell, J.H., Kochan, T.A. & von Nordenflytch, A. 2009">{{cite book|url=http://www.cornellpress.cornell.edu/book/?GCOI=80140100965480 |author=Bamber, G.J. |author2=Gittell, J.H. |author3=Kochan, T.A. |author4=von Nordenflytch, A. |year=2009 |title=Up in the Air: How Airlines Can Improve Performance by Engaging their Employees|publisher=Cornell University Press, Ithaca |chapter=chapter 5}}</ref> |

|||

In recognition of the essential national economic role of a healthy aviation system, Congress authorized partial compensation of up to $5 billion in cash subject to review by the [[U.S. Department of Transportation]] and up to $10 billion in loan guarantees subject to review by a newly created [[Air Transportation Stabilization Board]] (ATSB). The applications to DOT for reimbursements were subjected to rigorous multi-year reviews not only by DOT program personnel but also by the [[Government Accountability Office]]<ref>{{cite web |url=https://www.gao.gov/new.items/d04725r.pdf |archive-url=https://ghostarchive.org/archive/20221009/https://www.gao.gov/new.items/d04725r.pdf |archive-date=2022-10-09 |url-status=live |title=Subject: Aviation Assistance: Compensation Criteria and Payment Equity under the Air Transportation Safety and System Stabilization Act|date=4 June 2004 |website=www.gao.gov|access-date=18 July 2020}}</ref> and the DOT Inspector General.<ref>[http://www.oig.dot.gov/StreamFile?file=/data/pdfdocs/aa20011024.pdf] {{webarchive|url=https://web.archive.org/web/20090717225216/http://www.oig.dot.gov/StreamFile?file=%2Fdata%2Fpdfdocs%2Faa20011024.pdf|date=17 July 2009}}</ref><ref>[http://www.oig.dot.gov/StreamFile?file=/data/pdfdocs/cr2003092.pdf] {{webarchive|url=https://web.archive.org/web/20090717231319/http://www.oig.dot.gov/StreamFile?file=%2Fdata%2Fpdfdocs%2Fcr2003092.pdf|date=17 July 2009}}</ref> |

|||

Ultimately, the federal government provided $4.6 billion in one-time, subject-to-income-tax cash payments to 427 U.S. air carriers, with no provision for repayment, essentially a gift from the taxpayers. (Passenger carriers operating scheduled service received approximately $4 billion, subject to tax.)<ref>{{cite web|url=http://www.dot.gov/affairs/carrierpayments.htm |title=U |publisher=Dot.gov |access-date=22 August 2010 |url-status=dead |archive-url=https://web.archive.org/web/20100527104415/http://www.dot.gov/affairs/carrierpayments.htm |archive-date=27 May 2010 }}</ref> In addition, the ATSB approved loan guarantees to six airlines totaling approximately $1.6 billion. Data from the [[United States Department of the Treasury|U.S. Treasury Department]] show that the government recouped the $1.6 billion and a profit of $339 million from the fees, interest and purchase of discounted airline stock associated with loan guarantees.<ref>{{cite web|url=http://www.treas.gov/offices/domestic-finance/atsb/ |title=Air Transportation Stabilization Board |publisher=Treas.gov |date=22 September 2001 |access-date=22 August 2010|archive-url = https://web.archive.org/web/20080709052637/http://www.treas.gov/offices/domestic-finance/atsb/ |archive-date = 9 July 2008|url-status=dead}}</ref> |

|||

The three largest [[major carrier]]s and [[Southwest Airlines]] control 70% of the U.S. passenger market.<ref name=AvWeek14May2018/> |

|||

===Asia=== |

|||

[[File:Tata Sons' Airline Timetable Image, Summer 1935 (interior).jpg|thumb|1935 Timetable of [[Tata Airlines]], founded in 1932]] |

|||

Although [[Philippine Airlines]] (PAL) was officially founded on February 26, 1941, its license to operate as an airliner was derived from merged Philippine Aerial Taxi Company (PATCO) established by mining magnate Emmanuel N. Bachrach on 3 December 1930, making it Asia's oldest scheduled carrier still in operation.<ref>{{cite book|url=http://hawaii.gov/hawaiiaviation/hawaii-commercial-aviation/philippine-air-lines |title=Above the Pacific |first=William Joseph |last=Horvat |date=1966 |isbn=978-0-8168-0000-1 |publisher=Hawaii.gov |access-date=22 August 2010}}</ref> Commercial air service commenced three weeks later from [[Manila]] to [[Baguio]], making it Asia's first airline route. Bachrach's death in 1937 paved the way for its eventual merger with Philippine Airlines in March 1941 and made it Asia's oldest airline. It is also the oldest airline in Asia still operating under its current name.<ref name="PAL">Jane, ''[http://www.janes.com Jane's airlines & airliners By Jeremy Flack]'', First Edition, 2003, {{ISBN|978-0-00-715174-5}}</ref> Bachrach's majority share in PATCO was bought by beer magnate Andres R. Soriano in 1939 upon the advice of General [[Douglas MacArthur]] and later merged with newly formed Philippine Airlines with PAL as the surviving entity. Soriano has controlling interest in both airlines before the merger. PAL restarted service on 15 March 1941, with a single [[Beech Model 18]] NPC-54 aircraft, which started its daily services between [[Manila]] (from [[Nielson Field]]) and [[Baguio]], later to expand with larger aircraft such as the DC-3 and Vickers Viscount. |

|||

[[Cathay Pacific]] was one of the first airlines to be launched among the other Asian countries in 1946 along with [[Asiana Airlines]], which later joined in 1988. The license to operate as an airliner was granted by the federal government body after reviewing the necessity at the national assembly. The [[Hanjin]] occupies the largest ownership of Korean Air as well as few low-budget airlines as of now. Korean Air is one of the four founders of [[SkyTeam]], which was established in 2000. Asiana Airlines joined [[Star Alliance]] in 2003. Korean Air and Asiana Airlines comprise one of the largest combined airline miles and number of passenger served at the regional market of Asian airline industry |

|||

[[India]] was also one of the first countries to embrace civil aviation.<ref>{{cite book|author1=Pran Nath Seth|author2=Pran Nath Seth, Sushma Seth Bhat|title=An Introduction To Travel And Tourism|url=https://books.google.com/books?id=AcGn-Fmc43sC&pg=PA111|year=2003|publisher=Sterling Publishers Pvt. Ltd|isbn=978-81-207-2482-2|page=111}}</ref> One of the first Asian airline companies was [[Air India]], which was founded as [[Tata Airlines]] in 1932, a division of Tata Sons Ltd. (now [[Tata Group]]). The airline was founded by India's leading industrialist, [[JRD Tata]]. On 15 October 1932, J. R. D. Tata himself flew a single engined [[De Havilland Puss Moth]] carrying air mail (postal mail of [[Imperial Airways]]) from [[Karachi]] to [[Mumbai|Bombay]] via [[Ahmedabad]]. The aircraft continued to [[Madras]] via Bellary piloted by [[Royal Air Force]] pilot [[Nevill Vintcent]]. Tata Airlines was also one of the world's first major airlines which began its operations without any support from the Government.<ref>{{cite book|author=S Bhatt|title=International Environmental Law|url=https://books.google.com/books?id=s0g7tCYYu-gC&pg=PA175|year=2007|publisher=APH Publishing|isbn=978-81-313-0125-8|page=175}}</ref> |

|||

With the outbreak of World War II, the airline presence in Asia came to a relative halt, with many new flag carriers donating their aircraft for military aid and other uses. Following the end of the war in 1945, regular commercial service was restored in India and Tata Airlines became a public limited company on 29 July 1946, under the name Air India. After the [[independence of India]], 49% of the airline was acquired by the [[Government of India]]. In return, the airline was granted status to operate international services from India as the designated flag carrier under the name [[Air India International]].<ref>{{Cite journal |last=Pandey |first=B.K. |date=April–May 2013 |title=Encouraging Changes |url=https://www.spsairbuz.com/ebook/32022013.pdf |archive-url=https://ghostarchive.org/archive/20221009/https://www.spsairbuz.com/ebook/32022013.pdf |archive-date=2022-10-09 |url-status=live |journal=SP's AirBuz |volume=6 |issue=2 |pages=32}}</ref> |

|||

On 31 July 1946, a chartered Philippine Airlines (PAL) [[DC-4]] ferried 40 American servicemen to [[Oakland, California|Oakland]], [[California]], from Nielson Airport in [[Makati]] with stops in [[Guam]], [[Wake Island]], [[Johnston Atoll]] and [[Honolulu]], [[Hawaii]], making PAL the first Asian airline to cross the [[Pacific Ocean]]. A regular service between [[Manila]] and [[San Francisco]] was started in December. It was during this year that the airline was designated as the flag carrier of Philippines.<ref>{{Cite web |date=2020-09-23 |title=History and Milestone |url=https://www.philippineairlines.com/zh-TW/TC/home/AboutUs/HistoryAndMilestone |url-status=dead |archive-url=https://web.archive.org/web/20200923024837/https://www.philippineairlines.com/zh-TW/TC/home/AboutUs/HistoryAndMilestone |archive-date=2020-09-23 |access-date=2022-12-01 |website=}}</ref> |

|||

During the era of [[decolonization]], newly born Asian countries started to embrace air transport. Among the first Asian carriers during the era were [[Cathay Pacific]] of [[Hong Kong]] (founded in September 1946), [[Orient Airways]] (later [[Pakistan International Airlines]]; founded in October 1946), [[Air Ceylon]] (later [[SriLankan Airlines]]; founded in 1947), [[Malayan Airways Limited]] in 1947 (later [[Singapore Airlines|Singapore]] and [[Malaysia Airlines]]), [[El Al]] in [[Israel]] in 1948, [[Garuda Indonesia]] in 1949, [[Japan Airlines]] in 1951, [[Thai Airways]] in 1960, and [[Korean National Airlines]] in 1947.{{Citation needed|date=January 2020}} |

|||

[[Singapore Airlines]] had won quality awards.<ref>{{Cite news|url=https://www.airlineratings.com/news/singapore-airlines-wins-major-awards/|title=Singapore Airlines Wins Major Awards|work=[[AirlineRatings]]|access-date=16 June 2020|language=en}}</ref><ref>{{Cite news|url=https://www.todayonline.com/singapore/singapore-airlines-voted-second-best-airline-world-behind-qatar-airways|title=Singapore Airlines voted second best airline in the world behind Qatar Airways |work=[[Today (Singapore newspaper)|Today]]|access-date=16 June 2020|language=en}}</ref> |

|||

===Latin America and Caribbean=== |

|||

[[File:Tam.a330-200.pt-mvl.arp.jpg|thumb|[[LATAM Airlines]] is the largest airline in [[Latin America]] in terms of number of annual passengers flown.]] |

|||

Among the first countries to have regular airlines in Latin America and the Caribbean were [[Bolivia]] with [[Lloyd Aéreo Boliviano]],<ref>{{Cite news|url=https://www.britannica.com/place/Bolivia/Transportation#ref312761|title=Bolivia - Transportation {{!}} history - geography|work=Encyclopedia Britannica|access-date=14 October 2017|language=en}}</ref> [[Cuba]] with [[Cubana de Aviación]], [[Colombia]] with [[Avianca]] (the first airline established in the Americas), Argentina with [[Aerolíneas Argentinas]], [[Chile]] with [[LAN Chile]] (today [[LATAM Airlines]]), [[Brazil]] with [[Varig]], the [[Dominican Republic]] with [[Dominicana de Aviación]], [[Mexico]] with [[Mexicana de Aviación]], [[Trinidad and Tobago]] with [[BWIA West Indies Airways]] (today [[Caribbean Airlines]]), [[Venezuela]] with [[Aeropostal]], [[Puerto Rico]] with [[Aerovias nacionales de puerto rico|Puertorriquena]]; and [[Grupo TACA|TACA]] based in [[El Salvador]] and representing several airlines of [[Central America]] ([[Costa Rica]], [[Guatemala]], [[Honduras]] and [[Nicaragua]]). All the previous airlines started regular operations well before [[World War II]]. Puerto Rican commercial airlines such as [[Prinair]], [[Oceanair]], [[Fina Air]] and [[Vieques Air Link]] came much after the second world war, as did several others from other countries like Mexico's [[Interjet]] and [[Volaris]], Venezuela's [[Aserca Airlines]] and others. |

|||

The air travel market has evolved rapidly over recent years in [[Latin America]]. Some industry estimates indicated in 2011 that over 2,000 new aircraft will begin service over the next five years in this region.<ref>{{cite web|title=Latin America needs more than 2,000 new passenger aircraft in next 20 years|url=http://www.airbus.com/presscentre/pressreleases/press-release-detail/detail/latin-america-needs-more-than-2000-new-passenger-aircraft-in-next-20-years/|url-status=dead|archive-url=https://web.archive.org/web/20111119202700/http://www.airbus.com/presscentre/pressreleases/press-release-detail/detail/latin-america-needs-more-than-2000-new-passenger-aircraft-in-next-20-years/|archive-date=19 November 2011|access-date=3 February 2017}}</ref> |

|||

These airlines serve domestic flights within their countries, as well as connections within Latin America and also overseas flights to North America, Europe, Australia, and Asia. |

|||

Only five airline groups – [[Avianca]], Panama's [[Copa Airlines|Copa]], Mexico's [[Volaris]], the Irelandia group and [[LATAM Airlines]] – have international subsidiaries and cover many destinations within the Americas as well as major hubs in other continents. LATAM with [[Chile]] as the central operation along with [[Peru]], [[Ecuador]], [[Colombia]], [[Brazil]] and [[Argentina]] and formerly with some operations in the [[Dominican Republic]]. The [[Avianca Holdings|Avianca]] group has its main operation in Colombia based around the hub in [[El Dorado International Airport|Bogotá]], Colombia, as well as subsidiaries in various Latin American countries with hubs in [[Monseñor Óscar Arnulfo Romero (airport)|San Salvador]], El Salvador, as well as [[Lima International Airport|Lima]], Peru, with a smaller operation in Ecuador.{{Citation needed|date=January 2020}} Copa has subsidiaries [[Copa Airlines Colombia]] and [[Wingo (airline)|Wingo]], both in Colombia, while Volaris of Mexico has [[Volaris Costa Rica]] and [[Volaris El Salvador]], and the Irelandia group formerly included [[Viva Aerobus]] of Mexico; it now includes [[Viva Colombia]] and [[Viva Air Peru]]. |

|||

==Regulation== |

|||

===National=== |

|||

[[File:British Airways (27078321943).jpg|thumb|[[Union Jack]] tails of [[British Airways]], UK's [[flag carrier]]]] |

|||

Many countries have [[Flag carrier|national airline]]s that the government owns and operates. Fully private airlines are subject to much government regulation for economic, political, and safety concerns. For instance, governments often intervene to halt airline labor actions to protect the free flow of people, communications, and goods between different regions without compromising safety. |

|||

The United States, Australia, and to a lesser extent Brazil, Mexico, India, the United Kingdom, and Japan have "deregulated" their airlines. In the past, these governments dictated airfares, route networks, and other operational requirements for each airline. Since deregulation, airlines have been largely free to negotiate their own operating arrangements with different airports, enter and exit routes easily, and to levy airfares and supply flights according to market demand. The entry barriers for new airlines are lower in a deregulated market, and so the U.S. has seen hundreds of airlines start up (sometimes for only a brief operating period). This has produced far greater competition than before deregulation in most markets. The added competition, together with pricing freedom, means that new entrants often take market share with highly reduced rates that, to a limited degree, full service airlines must match. This is a major constraint on profitability for established carriers, which tend to have a higher cost base. |

|||

As a result, profitability in a deregulated market is uneven for most airlines. These forces have caused some major airlines to go out of business, in addition to most of the poorly established new entrants. |

|||

In the United States, the airline industry is dominated by four large firms. Because of industry consolidation, after fuel prices dropped considerably in 2015, very little of the savings were passed on to consumers.<ref>"Too Much of a Good Thing." ''The Economist'' 26 March 2016: 23. print.</ref> |

|||

===International=== |

|||

[[File:La Maison de l-OACI - 11a.jpg|thumb|[[International Civil Aviation Organization]] headquarters in [[Montreal]]]] |

|||

Groups such as the [[International Civil Aviation Organization]] establish worldwide standards for safety and other vital concerns. Most international air traffic is regulated by bilateral agreements between countries, which designate specific carriers to operate on specific routes. The model of such an agreement was the [[Bermuda Agreement]] between the US and UK following World War II, which designated airports to be used for transatlantic flights and gave each government the authority to nominate carriers to operate routes. |

|||

Bilateral agreements are based on the "[[freedoms of the air]]", a group of generalized traffic rights ranging from the freedom to overfly a country to the freedom to provide domestic flights within a country (a very rarely granted right known as [[cabotage]]). Most agreements permit airlines to fly from their home country to designated airports in the other country: some also extend the freedom to provide continuing service to a third country, or to another destination in the other country while carrying passengers from overseas. |

|||

In the 1990s, "[[open skies]]" agreements became more common. These agreements take many of these regulatory powers from state governments and open up international routes to further competition. Open skies agreements have met some criticism, particularly within the European Union, whose airlines would be at a comparative disadvantage with the United States' because of [[cabotage]] restrictions. |

|||

==Economy== |

|||

In 2017, 4.1 billion passengers have been carried by airlines in 41.9 million commercial scheduled flights (an average payload of {{#expr:4100/41.9round0}} passengers), for 7.75 trillion [[passenger kilometre]]s (an average trip of {{#expr:7750/4.100round0}} km) over 45,091 airline routes served globally. In 2016, air transport generated $704.4 billion of revenue in 2016, employed 10.2 million workers, supported 65.5 million jobs and $2.7 trillion of economic activity: 3.6% of the global [[GDP]].<ref name=ATAGOct2018>{{cite web |url= https://www.aviationbenefits.org/media/166344/abbb18_full-report_web.pdf |archive-url=https://ghostarchive.org/archive/20221009/https://www.aviationbenefits.org/media/166344/abbb18_full-report_web.pdf |archive-date=2022-10-09 |url-status=live |publisher= Air Transport Action Group |title= Aviation: Benefits Beyond Borders |date= October 2018}}</ref> |

|||

In July 2016, the total weekly airline capacity was 181.1 billion [[Available Seat Kilometers]] (+6.9% compared to July 2015): 57.6bn in Asia-Pacific, 47.7bn in Europe, 46.2bn in North America, 12.2bn in Middle East, 12.0bn in Latin America and 5.4bn in Africa.<ref>{{cite news |url= http://html5.pagesuite-professional.co.uk/desktop/stage/default.aspx?pnum=78&edid=e030c749-44c6-4ab0-af51-84e8f4424689 |title= Capacity snapshot |work= Airline Business |date= July–August 2016 |publisher= Flight Global |page= 78}}</ref> |

|||

{| class="wikitable" |

|||

|+Top 150 airline groups<ref name="WorldAirlineRankings2017">{{cite web|date=2017|title=World Airline Rankings|url=https://www.flightglobal.com/asset/18223|url-status=dead|archive-url=https://web.archive.org/web/20170930132154/https://www.flightglobal.com/asset/18223|archive-date=30 September 2017|work=Flight Global}}</ref> |

|||

! !! 2016 !! 2015 !! 2014 !! 2013 !! 2012 !! 2011 !! 2010 !! 2009 !! 2008 |

|||

|- |

|||

! Revenue ($bn) |

|||

| 694 || 698 || 704 || 684 || 663 || 634 || 560 || 481 || 540 |

|||

|- |

|||

! Operating result ($bn) |

|||

| 58.9 || 65.0 || 30.4 || 27.5 || 20.7 || 21.3 || 32.4 || 1.7 || −15.3 |

|||

|- |

|||

! Operating margin (%) |

|||

| 8.5% || 9.3% || 4.3% || 4.0% || 3.1% || 3.4% || 5.8% || 0.4% || −2.8% |

|||

|- |

|||

! Net result ($bn) |

|||

| 34.2 || 42.4 || 11.7 || 15.3 || 4.6 || 0.3 || 19.0 || −5.7 || −32.5 |

|||

|- |

|||

! Net margin (%) |

|||

| 4.9% || 6.1% || 1.7% || 2.2% || 0.7% || 0.0% || 3.4% || −1.2% || −6.0% |

|||

|} |

|||

===Costs=== |

|||

[[File:virgin atlantic a340-600 g-vyou arp.jpg|thumb|An [[Airbus A340]]-600 of [[Virgin Atlantic]]. In October 2008, Virgin Atlantic offered to combine its operations with [[British Midland International|BMI]] in an effort to reduce operating costs.<ref>{{cite news|last=Robertson|first=David|date=29 October 2008|title=Virgin proposes tieup with BMI and Lufthansa|work=The Times|location=London|url=http://business.timesonline.co.uk/tol/business/industry_sectors/transport/article5037731.ece|url-status=dead|access-date=23 April 2010|archive-url=https://web.archive.org/web/20090107164938/http://business.timesonline.co.uk/tol/business/industry_sectors/transport/article5037731.ece|archive-date=7 January 2009}}</ref>]] |

|||

Airlines have substantial fixed and operating costs to establish and maintain air services: labor, fuel, airplanes, engines, spares and parts, IT services and networks, airport equipment, airport handling services, booking commissions, advertising, catering, training, [[aviation insurance]] and other costs. Thus all but a small percentage of the income from ticket sales is paid out to a wide variety of external providers or internal cost centers. |

|||

Moreover, the industry is structured so that airlines often act as tax collectors. Airline fuel is untaxed because of a series of treaties existing between countries. Ticket prices include a number of fees, taxes and surcharges beyond the control of airlines. Airlines are also responsible for enforcing government regulations. If airlines carry passengers without proper documentation on an international flight, they are responsible for returning them back to the original country. |

|||

Analysis of the 1992–1996 period shows that every player in the air transport chain is far more profitable than the airlines, who collect and pass through fees and revenues to them from ticket sales. While airlines as a whole earned 6% return on capital employed (2–3.5% less than the cost of capital), airports earned 10%, catering companies 10–13%, handling companies 11–14%, aircraft lessors 15%, aircraft manufacturers 16%, and global distribution companies more than 30%.<ref>{{citation |author= [[Jean-Cyril Spinetta]] |date= November 2000 |title= The New Economics |work= Air Transport: Global Economics require Global Regulatory Perspectives round table |publisher= IATA-AEA |location= Brussels}}, unpublished, quoted in {{cite book |author= Doganis, R. |date= 2002 |title= Flying off course : the economics of international airlines |edition= 3rd |location= London |publisher= Routledge |url= https://books.google.com/books?id=eR5unZWjOEUC&pg=PA6|page=6|isbn= 9780415213240 }}</ref> |

|||

There has been continuing cost competition from [[low cost airline]]s. Many companies emulate [[Southwest Airlines]] in various respects.<ref>{{Cite news|url=https://www.dallasnews.com/business/airlines/2015/10/08/the-southwest-effect-is-alive-and-well-airline-executives-say|title=The Southwest effect is|date=8 October 2015|work=Dallas News|access-date=14 October 2017|language=en}}</ref> The lines between full-service and low-cost airlines have become blurred – e.g., with most "full service" airlines introducing baggage check fees despite Southwest not doing so. |

|||

Many airlines in the U.S. and elsewhere have experienced business difficulty. U.S. airlines that have declared [[Chapter 11]] bankruptcy since 1990 have included [[American Airlines]], [[Continental Airlines]] (twice), [[Delta Air Lines]], [[Northwest Airlines]], [[Pan Am]], [[United Airlines]] and [[US Airways]] (twice). |

|||

Where an airline has established an engineering base at an airport, then there may be considerable economic advantages in using that same airport as a preferred focus (or "hub") for its scheduled flights. |

|||

[[Fuel hedging]] is a [[contractual]] tool used by transportation companies like airlines to reduce their exposure to volatile and potentially rising fuel costs. Several low-cost carriers such as Southwest Airlines adopt this practice. Southwest is credited with maintaining strong business profits between 1999 and the early 2000s due to its fuel hedging policy. Many other airlines are replicating Southwest's hedging policy to control their fuel costs.<ref name = economist19jan2015>{{Cite news|url=https://www.economist.com/gulliver/2015/01/19/gambles-that-havent-paid-off|title=Gambles that haven't paid off|newspaper=The Economist|issn=0013-0613|date=19 January 2015}}</ref> |

|||

Operating costs for US [[major airline]]s are primarily aircraft [[operating expense]] including [[jet fuel]], [[aircraft maintenance]], [[depreciation]] and [[aircrew]] for 44%, servicing expense for 29% (traffic 11%, passenger 11% and aircraft 7%), 14% for reservations and sales and 13% for [[overheads]] (administration 6% and advertising 2%). An average US major [[Boeing 757]]-200 flies {{cvt|1252|mile|km}} stages 11.3 block hours per day and costs $2,550 per block hour: $923 of ownership, $590 of maintenance, $548 of fuel and $489 of crew; or $13.34 per 186 seats per block hour. For a [[Boeing 737-500]], a low-cost carrier like Southwest have lower operating costs at $1,526 than a full service one like United at $2,974, and higher [[productivity]] with 399,746 [[available seat miles|ASM]] per day against 264,284, resulting in a unit cost of {{#expr:152600/399746round2}} $cts/ASM against {{#expr:297400/264284round2}} $cts/ASM.<ref name=ICAO20feb2017>{{cite web |url= https://www.icao.int/MID/Documents/2017/Aviation%20Data%20and%20Analysis%20Seminar/PPT3%20-%20Airlines%20Operating%20costs%20and%20productivity.pdf |archive-url=https://ghostarchive.org/archive/20221009/https://www.icao.int/MID/Documents/2017/Aviation%20Data%20and%20Analysis%20Seminar/PPT3%20-%20Airlines%20Operating%20costs%20and%20productivity.pdf |archive-date=2022-10-09 |url-status=live |title= Airline Operating Costs and Productivity |date= 20 February 2017 |publisher= ICAO}}</ref> |

|||

[[McKinsey]] observes that "newer technology, larger aircraft, and increasingly efficient operations continually drive down the cost of running an airline", from nearly 40 US cents per [[available seat kilometer|ASK]] at the beginning of the jet age, to just above 10 cents since 2000. Those improvements were passed onto the customer due to high competition: fares have been falling throughout the history of airlines.<ref>{{cite web |url= https://www.mckinsey.com/industries/travel-transport-and-logistics/our-insights/a-better-approach-to-airline-costs# |title= A better approach to airline costs |date= July 2017 |author= Steve Saxon and Mathieu Weber |publisher= [[McKinsey]]}}</ref> |

|||

{{See also|Aviation taxation and subsidies}} |

|||

===Revenue=== |

|||

[[File:Diagram of an airline Global Distribution System.jpg|thumb|upright=1.5|Diagram of an airline [[Global Distribution System]]]] |

|||

Airlines assign prices to their services in an attempt to maximize profitability. The pricing of airline tickets has become increasingly complicated over the years and is now largely determined by computerized [[yield management]] systems. |

|||

Because of the complications in scheduling flights and maintaining profitability, airlines have many loopholes that can be used by the knowledgeable traveler. Many of these airfare secrets are becoming more and more known to the general public, so airlines are forced to make constant adjustments. |

|||

Most airlines use differentiated pricing, a form of [[price discrimination]], to sell air services at varying prices simultaneously to different segments. Factors influencing the price include the days remaining until departure, the booked load factor, the forecast of total demand by price point, competitive pricing in force, and variations by day of week of departure and by time of day. Carriers often accomplish this by dividing each cabin of the aircraft (first, business and economy) into a number of [[travel class]]es for pricing purposes. |

|||

A complicating factor is that of origin-destination control ("O&D control"). Someone purchasing a ticket from Melbourne to Sydney (as an example) for A$200 is competing with someone else who wants to fly Melbourne to Los Angeles through Sydney on the same flight, and who is willing to pay A$1400. Should the airline prefer the $1400 passenger, or the $200 passenger plus a possible Sydney-Los Angeles passenger willing to pay $1300? Airlines have to make hundreds of thousands of similar pricing decisions daily. |

|||

The advent of advanced computerized reservations systems in the late 1970s, most notably [[Sabre (computer system)|Sabre]], allowed airlines to easily perform [[cost-benefit analysis|cost-benefit analyses]] on different pricing structures, leading to almost perfect price discrimination in some cases (that is, filling each seat on an aircraft at the highest price that can be charged without driving the consumer elsewhere). |

|||

The intense nature of airfare pricing has led to the term "[[fare war]]" to describe efforts by airlines to undercut other airlines on competitive routes. Through computers, new airfares can be published quickly and efficiently to the airlines' sales channels. For this purpose the airlines use the [[Airline Tariff Publishing Company]] (ATPCO), who distribute latest fares for more than 500 airlines to [[Computer Reservation System]]s across the world. |

|||

The extent of these pricing phenomena is strongest in "legacy" carriers. In contrast, low fare carriers usually offer pre-announced and simplified price structure, and sometimes quote prices for each leg of a trip separately. |

|||

Computers also allow airlines to predict, with some accuracy, how many passengers will actually fly after making a reservation to fly. This allows airlines to overbook their flights enough to fill the aircraft while accounting for "no-shows", but not enough (in most cases) to force paying passengers off the aircraft for lack of seats, stimulative pricing for low demand flights coupled with [[overbooking]] on high demand flights can help reduce this figure. This is especially crucial during tough economic times as airlines undertake massive cuts to ticket prices to retain demand.<ref>{{cite web |url=http://news.cheapflights.co.uk/flights/2009/05/recession-prompts-surge-in-cheap-flights.html |title=Recession 'prompts surge in cheap flights' |publisher=News.cheapflights.co.uk |date=13 May 2009 |access-date=22 August 2010 |archive-url=https://web.archive.org/web/20091130120521/http://news.cheapflights.co.uk/flights/2009/05/recession-prompts-surge-in-cheap-flights.html |archive-date=30 November 2009 |url-status=dead }}</ref> |

|||

Over January/February 2018, the cheapest airline surveyed by price comparator [[rome2rio]] was now-defunct [[Tigerair Australia]] with $0.06/km followed by [[AirAsia X]] with $0.07/km, while the most expensive was [[Charterlines, Inc.]] with $1.26/km followed by [[Buddha Air]] with $1.18/km.<ref>{{cite news |url= https://www.rome2rio.com/labs/2018-global-flight-price-ranking/ |title= 2018 Global Flight Price Ranking: What's the world's cheapest airline? |publisher= [[rome2rio]] |date= 16 April 2018}}</ref> |

|||

For the [[IATA]], the global airline industry [[revenue]] was $754 billion in 2017 for a $38.4 billion collective [[Profit (accounting)|profit]], and should rise by 10.7% to $834 billion in 2018 for a $33.8 billion profit forecast, down by 12% due to rising [[jet fuel]] and [[Workforce|labor]] costs.<ref>{{cite news |url= http://aviationweek.com/commercial-aviation/airlines-formula-protecting-profits-higher-fares |title= Airlines' Formula For Protecting Profits: Higher Fares |date= 12 June 2018 |author= Jens Flottau, Adrian Schofield and Aaron Karp |work= [[Aviation Week & Space Technology]]}}</ref> |

|||

<!--Elasticity--> |

|||

The demand for air transport will be less [[Elasticity (economics)|elastic]] for [[flight length|longer flights]] than for shorter flights, and more elastic for leisure travel than for [[business travel]].<ref>{{cite web|author=David W. Gillen|author2=William G. Morrison|author3=Christopher Stewart|date=6 October 2008|title=Air Travel Demand Elasticities: Concepts, Issues and Measurement|url=https://www.fin.gc.ca/consultresp/Airtravel/airtravStdy_-eng.asp|url-status=dead|archive-url=https://web.archive.org/web/20090428190326/https://www.fin.gc.ca/consultresp/Airtravel/airtravStdy_-eng.asp|archive-date=28 April 2009|publisher=[[Department of Finance Canada]]}}</ref> |

|||

<!--Seasonality--> |

|||

Airlines often have a strong [[seasonality]], with traffic low in winter and peaking in summer. In Europe the most extreme market are the [[Greek islands]] with July/August having more than ten times the winter traffic, as [[Jet2]] is the most seasonal among [[low-cost carrier]]s with July having seven times the January traffic, whereas [[legacy carrier]]s are much less with only 85/115% variability.<ref>{{cite news |url= http://www.anna.aero/2017/03/01/greek-islands-jet2-com-seasonality-losers-europe/ |title= Seasonality: Jet2.com and Greek Islands most extreme in anna.aero leisure-legacy comparison |work= Airline Network News and Analysis |date= 1 March 2017 }}</ref> |

|||

===Assets and financing=== |

|||

[[File:Maslounge.jpg|thumb|The 'Golden Lounge' of [[Malaysia Airlines]] at [[Kuala Lumpur International Airport]] (KLIA).]] |

|||

Airline financing is quite complex, since airlines are highly leveraged operations. Not only must they purchase (or lease) new airliner bodies and engines regularly, they must make major long-term fleet decisions with the goal of meeting the demands of their markets while producing a fleet that is relatively economical to operate and maintain; comparably Southwest Airlines and their reliance on a single airplane type (the [[Boeing 737]] and derivatives), with the now defunct [[Eastern Air Lines]] which operated 17 different aircraft types, each with varying pilot, engine, maintenance, and support needs. |

|||

A second financial issue is that of [[Hedge (finance)|hedging]] [[Petroleum|oil]] and [[fuel]] purchases, which are usually second only to [[Labour (economics)|labor]] in its relative cost to the company. However, with the current high fuel prices it has become the largest cost to an airline. Legacy airlines, compared with new entrants, have been hit harder by rising fuel prices partly due to the running of older, less fuel efficient aircraft.<ref name="Bamber, G.J., Gittell, J.H., Kochan, T.A. & von Nordenflytch, A. 2009"/> While hedging instruments can be expensive, they can easily pay for themselves many times over in periods of increasing fuel costs, such as in the 2000–2005 period. |

|||

In view of the congestion apparent at many international [[airport]]s, the ownership of slots at certain airports (the right to take-off or land an aircraft at a particular time of day or night) has become a significant tradable asset for many airlines. Clearly take-off slots at popular times of the day can be critical in attracting the more profitable business traveler to a given airline's flight and in establishing a competitive advantage against a competing airline. |

|||

If a particular city has two or more airports, market forces will tend to attract the less profitable routes, or those on which competition is weakest, to the less congested airport, where slots are likely to be more available and therefore cheaper. For example, [[Reagan National Airport]] attracts profitable routes due partly to its congestion, leaving less-profitable routes to [[Baltimore-Washington International Airport]] and [[Dulles International Airport]].<ref>{{Cite web|url=https://wtop.com/baltimore/2018/11/which-d-c-area-airport-is-busiest/|title=Which DC-area airport is busiest?|date=21 November 2018|website=WTOP|language=en|access-date=17 March 2020}}</ref> |

|||

Other factors, such as surface transport facilities and onward connections, will also affect the relative appeal of different airports and some long-distance flights may need to operate from the one with the longest runway. For example, [[LaGuardia Airport]] is the preferred airport for most of [[Manhattan]] due to its proximity, while long-distance routes must use [[John F. Kennedy International Airport]]'s longer runways. |

|||

===Partnerships=== |

|||

{{Major airline alliances}} |

|||